Statutory Sick Pay calculator

Use our Statutory Sick Pay calculator to work out what you owe employees who have taken extended sick leave.

Use our Statutory Sick Pay calculator to work out what you owe employees who have taken extended sick leave.

.png?width=1000&height=790&name=Person%20using%20tablet%20(1).png)

Enter your employee's salary:

Select the start and end dates of sick leave:

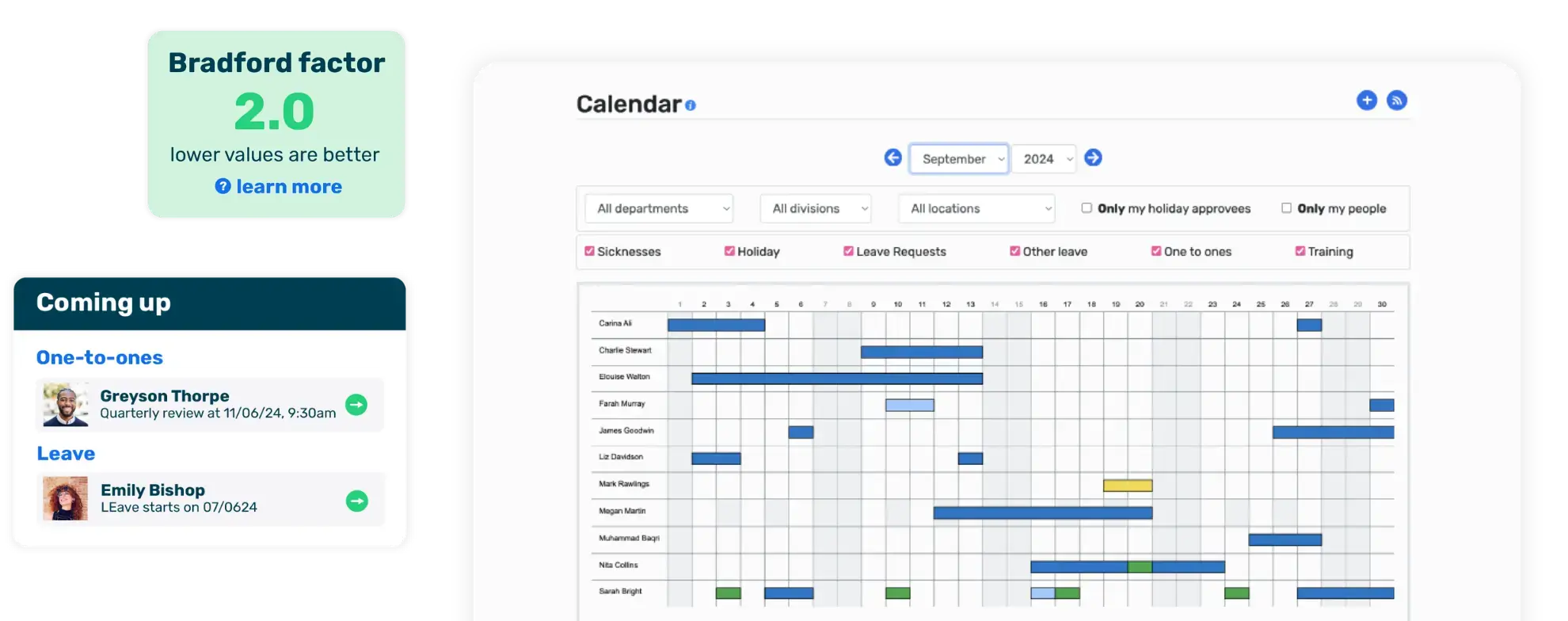

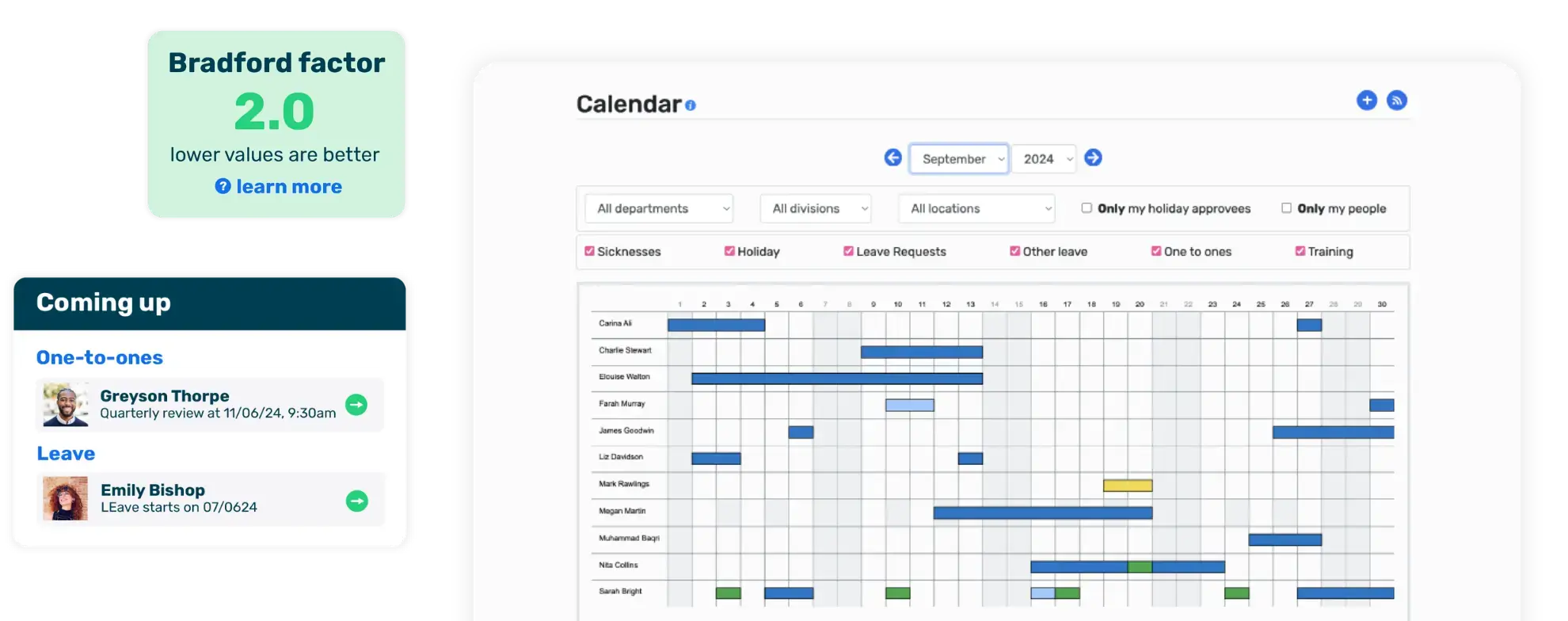

Save up to 4 hours a week with automated holiday management software

Give your people visibility of their own holiday entitlement and request leave whenever, wherever

See who’s off and when in a glance, from holiday, to maternity/paternity leave, to appointments and training

Visualise how much holiday has been booked and taken, and identify those at risk of burnout

Statutory Sick Pay (SSP) is financial support for UK employees when they can’t work because of illness. Discover what SSP is, what the new rates are and how to calculate your SSP entitlement right here.

Statutory Sick Pay (SSP) gives up to 28 weeks of financial support for employees in the UK who can’t work due to illness, this is essentially a basic income during a period of recovery.

Recent changes have increased the weekly SSP rate to £116.35 as of April 2024, but it’s only about 18% of the average UK wage, so planning is crucial during sick leave (for both employer and employee). It's worth noting, that from April 2025, weekly SSP will rise to £118.75.

Employers have to pay SSP from the 4th day of illness - however, updates to the Employment Rights Bill will change SSP to a day-one right, although when exactly this will come into play is still to be confirmed.

Statutory Sick Pay (SSP) is a financial help for UK employees who are off sick due to health issues. If you're unable to work due to illness, those who are eligible can receive financial support to help cover daily expenses during their recovery. Your employer provides this financial support, acting as a safety net for up to 28 weeks of illness.

SSP provides continuous payments (and support), this is especially helpful for those without employer-provided Occupational Sick Pay (OSP). Unlike OSP, which varies by company, SSP is the same across the UK. You can accumulate SSP over multiple sickness periods, as long as they’re connected, up to a total of 28 weeks. If there's a gap of more than 56 days between sickness periods, the allowance resets and you could be eligible for another 28 weeks.

Knowing how SSP works helps you manage time off when you’re ill. Understanding how you're covered and the application process for claiming benefits under SSP terms (even with the recent changes to the statutory rates) is key to planning your personal budget when sick.

There has been an update to Statutory Sick Pay (SSP) to reflect the changing economic climate and rising living costs. From April 6, 2025 the new weekly SSP rate will be £118.75, up from the previous tax year’s rate of £116.35 – an extra £2.40 a week to help employees when they’re off work sick. But this only an increase of 2.04% and only equates to about 18.33% of the average UK worker’s weekly wage (as of 2024) - understandably, some are calling for bigger increases in the adequacy of SSP.

For many employees who find themselves ill and can’t work this is good (ish) news. It also shows just how important it is to have a robust financial plan during illness. Knowing what you’re entitled to through SSP can help you manage your expenses when you’re off sick.

Let’s break down how to calculate your entitlement using the latest rates, so you know exactly what you’ll receive if you do fall ill.

Breaking down the process of calculating Statutory Sick Pay (SSP) into simple steps can help. At the moment, SSP starts to accrue after an employee’s third sick day, these are called “waiting days”. An employee is only eligible for SSP on the days they normally work.

To work out how much daily SSP an individual should get, you need to divide the weekly rate by the number of qualifying days in a week. For example, with a five-day working week and a weekly SSP rate of £116.35, you would divide £116.35 by 5. Then, multiply this daily amount by the number of qualified sick pay days in that period - excluding those initial 3 waiting days.

If someone is off work for 9 sickness days in a row, SSP would apply from day 4 to 9 which is 6 qualified sick pay days in total.

This way helps both employers and employees understand their responsibilities for sick pay when someone needs time off due to illness or injury, keeping it fair for everyone.

Use our SSP calculator to quickly and easily work out daily entitlements. It calculates the amount owed based on the weekly SSP rate and the number of qualifying days. With the 2025/26 tax year approaching, this tool is more important than ever to help you stay compliant with the changing rules.

All you need to do is enter the information, like periods of sickness and qualifying days, into this tool and you’ll get instant results for your SSP calculations. This is a big time saver and can help cut down the risk of mistakes – good news for both employers and employees.

At the top of this page is our SSP calculator to help with your calculations. Now we have a grasp on SSP calculations let’s look at who meets the eligibility criteria for SSP.

Employees must earn a minimum of £123 per week before tax to be eligible for Statutory Sick Pay (SSP). This threshold is set so SSP can help those who rely on their income when they’re unable to work due to sickness. Even agency workers, casual workers and zero-hours contracts employees may be entitled to SSP as long as they meet the earnings criteria. (Keep in mind, that this will be changing to £125 from April 2025 and that the lower earnings limit is due to be removed, although timelines aren't yet finalised).

A deeper understanding of SSP entitlements means looking at specific cases like periods of incapacity for work (PIW), any connected episodes of illness, and part-time employees paid SSP.

A PIW or period of incapacity for work is a key part of qualifying Statutory Sick Pay (SSP). An employee qualifies for SSP if they are sick and unable to work for at least 4 days in a row (although this is set to change in 2025). These 4 days can include weekends and bank holidays if they fall within the continuous period of illness.

Knowing what constitutes a PIW is important as it supports an individual’s right to claim SSP. If employees don’t meet this threshold, they won’t qualify for SSP, so it's important to track sick leave.

If an employee has multiple sick episodes that are close together, they may count as one continuous period for Statutory Sick Pay (SSP). This happens when the sickness periods are no more than 8 weeks apart. If an employee gets sick again within 8 weeks of their last illness, it's treated as part of the same sickness period.

Understanding connected periods is important for calculating SSP correctly. It stops the 3 waiting days from restarting for each new sickness, ensuring employees get sick pay without delays.

Part-time employees can qualify for Statutory Sick Pay (SSP) just like full-time employees as long as they earn at least £123 before tax per week (£125 from April 2025). They must meet this minimum earnings threshold to be eligible for SSP. To avoid legal issues and comply with employment laws, it’s essential employers calculate the correct amount of SSP for part-time staff members.

Calculating SSP for part-time employees is crucial. Why? Unfortunately, errors can lead to disputes and potentially an employment tribunal. For accuracy and fairness in these calculations use HR and payroll software. This can help you stay on track, and stay compliant with the rules, as well as make sure employees are happy with their sick pay arrangements.

Employers have a key role in administering Statutory Sick Pay which involves paying SSP to employees who qualify. All UK employers must pay SSP from the fourth day an employee is ill (keep an eye out for this changing to day one in 2025 - timelines to be finalised). Employers must check that their staff meets the criteria to receive SSP and communicate with anyone who doesn’t meet the criteria.

To stay compliant and avoid disputes, it’s essential employers pay sick pay quickly and accurately. Using HR software like Breathe means that employees can report sickness within 7 days, alongside payroll software that can calculate and pay SSP quickly and efficiently.

A good payroll system keeps employee information safe and automates tasks like reports and calculations. This reduces the amount of work for you and helps make sure you're following the rules for sick pay.

If you can’t get SSP what other options are available? The Employment and Support Allowance (ESA) is one such alternative, it’s a benefit for people who are ill or disabled and not covered by SSP. This is useful for those who are self-employed or those who earn below the SSP threshold.

Universal Credit is another option that can complement SSP or ESA in certain situations. It’s to help with living costs such as housing costs when sickness reduces earnings. Make sure you report any changes to your circumstances to your DWP office so you can claim benefits and ask about increases if applicable. Receiving SSP won’t affect tax credit eligibility, so you can have financial stability during periods of sickness-related work absence.

Using payroll software makes calculating and paying SSP to employees a breeze. This technology does precise calculations to reduce errors so employees get what they deserve during sick leave.

With this type of software taking care of long-term sick leave, submitting SSP1 forms and integrating with timesheet systems, this helps to simplify payroll tasks. By automating these tasks you can focus on business strategy while staff on sick leave get the proper financial support they need, through accurate payment of SSP.

Managing complex SSP situations means understanding how different periods of sickness and other benefits work together. When employees have overlapping sickness periods, adjustments might be needed to make sure they're paid correctly without going over the maximum limit.

There's always a chance that employees on parental leave could become ill. In these cases, they can get sick pay in addition to their existing benefits while keeping their right to SSP. You need to consider the initial 3 qualifying days (a waiting period where no SSP is paid) to handle these complex cases (watch out for the changes coming in 2025).

It’s the employer’s job to make sure they handle these overlapping rights correctly to avoid mistakes and follow the law.

Mastering Statutory Sick Pay (SSP) can be difficult, but knowing common issues and solutions helps a lot. Employers need to pay SSP on time and correctly to eligible employees. Calculating SSP can get tricky, especially if someone’s sick leave overlaps with maternity leave, so it’s important to handle it carefully to avoid mistakes or payment problems.

It’s important for both employers and employees to understand Statutory Sick Pay (SSP). This includes knowing what SSP covers, recent rate changes, how to calculate it (either by hand or using a calculator like the one above), and who is eligible. Employers need to make sure they pay SSP correctly and on time. Using HR and payroll software can make this process easier.

Individuals who aren't eligible for Statutory Sick Pay may consider other sources of financial help such as Employment and Support Allowance (ESA) or Universal Credit. Being aware of these benefits and using the right tools, helps both employees on sick leave and employers providing compensation to manage support allowance matters confidently and in line with the law.

Take a free trial of Breathe to see for yourself how easy it is to win back time in your day and help your people be the best they can be.

What does SSP stand for?

SSP stands for Statutory Sick Pay, a benefit for employees who are off work due to illness, depending on how much they earn and their situation.

How long can I claim SSP for?

Employees can claim Statutory Sick Pay (SSP) for up to 28 weeks, which can be taken in one continuous period or linked periods of sickness.

What are qualifying days for SSP?

Qualifying days for Statutory Sick Pay (SSP) are the days an employee is normally scheduled to work and SSP is only paid for these days after the first 3 waiting days (although Employment Rights Bill changes are set to change this to day one in 2025 - timelines to be finalised).

How do I calculate the daily SSP rate?

To calculate the daily SSP rate divide the weekly SSP rate by the number of qualifying days your employee works in a week.

This will give you the correct daily rate.

Are part-time employees entitled to SSP?

Yes - part-time employees are entitled to SSP.

Stay ahead of 2025: 8 Employment Law changes made simple