National Insurance contributions for employers

National Insurance contributions (NICs) are the backbone of the UK's social security system. Employers pay these contributions so employees can qualify for benefits such as the state pension and National Insurance-based entitlements. In short, your business needs to comply with NICs for both legal and employee benefits.

All employers with staff aged 16 and over earning above specific thresholds must pay National Insurance contributions. Beyond being a legal requirement these contributions are an investment in your workforce's future and grants access to contributory benefits.

Knowing how much National Insurance your business owes and understanding how it’s calculated is key to financial management.

Earnings thresholds explained

Earnings thresholds play a big part in determining National Insurance payments. The Secondary Threshold is the point where employers start paying National Insurance for their employees. Earnings below this threshold are exempt.

At the other end of the scale the Upper Earnings Limit is the cap on the amount of earnings subject to the standard rate of NICs. Knowing these thresholds allows you to convert your employees’ gross earnings into National Insurance contributions.

National Insurance rates 2024/25

This was by far the most significant announcement from the 2024 Autumn Budget. In the speech, the Chancellor announced that:

- Class 1 National Insurance payments will rise from 13.8% to 15%.

- The threshold for employers to start paying these contributions will decrease from £9,100 a year to £5,000.

This is a significant tax rise for employers. In fact, it amounts to an increase of roughly £986 a year for employees on £40,000 and around £1,226 a year for those on £60,000.

But for some SMEs, there’s a silver lining. The Employment Allowance will also be increased from £5,000 to £10,500, meaning you’ll be able to employ roughly four employees on minimum wage before paying National Insurance.

Calculating National Insurance

Calculating employer National Insurance is simpler than it sounds. You just apply the rate to your employees’ earnings above the Secondary Threshold - and with the right tools, it takes seconds.

Our National Insurance calculator does the hard work for you. It shows your employer contributions for each financial year, based on an employee’s salary, and lets you compare changes from one year to the next - so you can stay informed and plan ahead with confidence.

To help visualise it, here’s a quick example calculation:

Example calculation for an employer

An employer is calculating NICs for an employee earning £1,000 per week. The employer pays 15% on earnings above the Secondary Threshold. With the employment allowance of £10,500 the first portion of the NICs may be offset against this allowance.

Salary sacrifice schemes for employers

Salary sacrifice schemes allow employees to reduce their gross pay in exchange for benefits like pension contributions. This reduction in gross pay reduces the amount of National Insurance for employers too.

However, employers need to make sure that employees’ salaries don’t fall below the National Minimum Wage when using these schemes.

Special considerations in National Insurance for employers

Special considerations in National Insurance calculations include benefits-in-kind which can affect the contributions owed. Employers must report these using forms like the P11D and may face additional NICs.

Directors’ NICs require special attention as they are calculated annually not monthly. Understanding these rules is key to getting it right.

Benefits-in-kind and Class 1A contributions

Benefits-in-kind such as company cars or health insurance are non-cash benefits provided to employees. These benefits attract Class 1A contributions which are paid annually via the P11D(b) form. Employers must report these benefits accurately to ensure the correct amount of NICs is paid.

Understanding benefits-in-kind helps in managing overall contributions.

Directors’ National Insurance contributions

Directors’ National Insurance contributions are unique in that they are calculated on their annual income. This annual earnings period affects both the timing and amount of contributions, unlike regular employees.

Directors’ earnings can be classed differently for NIC purposes. Understanding these differences means compliance and correct payment of contributions.

National Insurance calculator for employers

Working out NICs doesn’t have to be complicated.

Our calculator at the top of the page gives you a quick estimate of employer NI contributions based on annual salary and financial year.

If you need a more detailed breakdown - including both employer and employee contributions - the Gov.UK National Insurance calculator can help.

Voluntary contributions and National Insurance records for employers

Voluntary contributions can be useful for employers with employees with gaps in their National Insurance history, to keep them eligible for benefits and the state pension. Check employees’ National Insurance records regularly to ensure no gaps affect future benefits.

How National Insurance affects state pension for employers

National Insurance contributions affect state pension eligibility for employees. At least 10 years of contributions are needed to qualify for the new state pension which can be achieved through paid contributions, credits, or voluntary contributions.

Number of qualifying years determines the state pension amount. Having a complete NI record is key to maximising state pension benefits.

Changes in National Insurance rates and thresholds for employers

Recent changes to NI rates and thresholds have a big impact on employers. In April 2025, the employer NIC rate increased from 13.8% to 15%, while the Employment Allowance rose to £10,500.

Staying informed about these changes will help you plan ahead and manage your payroll costs effectively.

For example: for an employee earning £40,000 per year.

- 2022/23: Secondary Threshold £9,100. Employer pays 13.8% on £30,900 = £4,264.20

- 2023/24: Thresholds frozen. Employer still pays 13.8% on £30,900 = £4,264.20 (but more workers crossed the threshold due to frozen limits)

- 2025/26: Secondary Threshold £5,000. Employer pays 15% on £35,000 = £5,250.

NI changes across tax years

National Insurance rates and thresholds have changed over the past few years, affecting how much employers contribute. Here's a quick look at what's changed.

- 2022/23: Employer NIC rate at 13.8%, Secondary Threshold £9,100

- 2023/24: NIC rate stayed at 13.8%, thresholds frozen, meaning more liability as wages rose

- 2024/25: NIC rate still 13.8%, but thresholds tightened

- 2025/26: Employer NIC rate rises to 15%, Secondary Threshold reduced to £5,000, Employment Allowance increased to £10,500

These changes mean higher employer contributions overall, so it’s worth reviewing your payroll budgets and forecasts each year.

National Insurance for self-employed individuals from an employer’s perspective

While this is aimed at employers, understanding self-employed NICs can be useful if you have contractors in your business.

Self-employed individuals pay different NIC classes:

Key points for employers to understand:

-

Self-employed workers manage their own NICs, unlike employees where employers contribute.

-

Exemptions apply for very low profits or specific groups.

-

Employers hiring contractors should confirm whether engagements are inside or outside employment law to avoid liability.

Do employees pay National Insurance if they earn less than the personal allowance?

No. Employees earning below the Primary Threshold don’t pay NICs. Employers only start paying once earnings exceed the Secondary Threshold. However, individuals may still receive NI credits in certain situations, such as if they claim specific benefits.

Summary for employers

In summary, knowing and calculating National Insurance correctly is key for employers. From knowing the thresholds and rates to using the NI calculator, be informed and you’ll manage your finances better.

By following this guide you’ll be compliant, optimise your contributions, and secure your business’s financial future. Stay up to date with national insurance changes, use payroll software for accurate calculations and consider benefits and allowances on your overall liability.

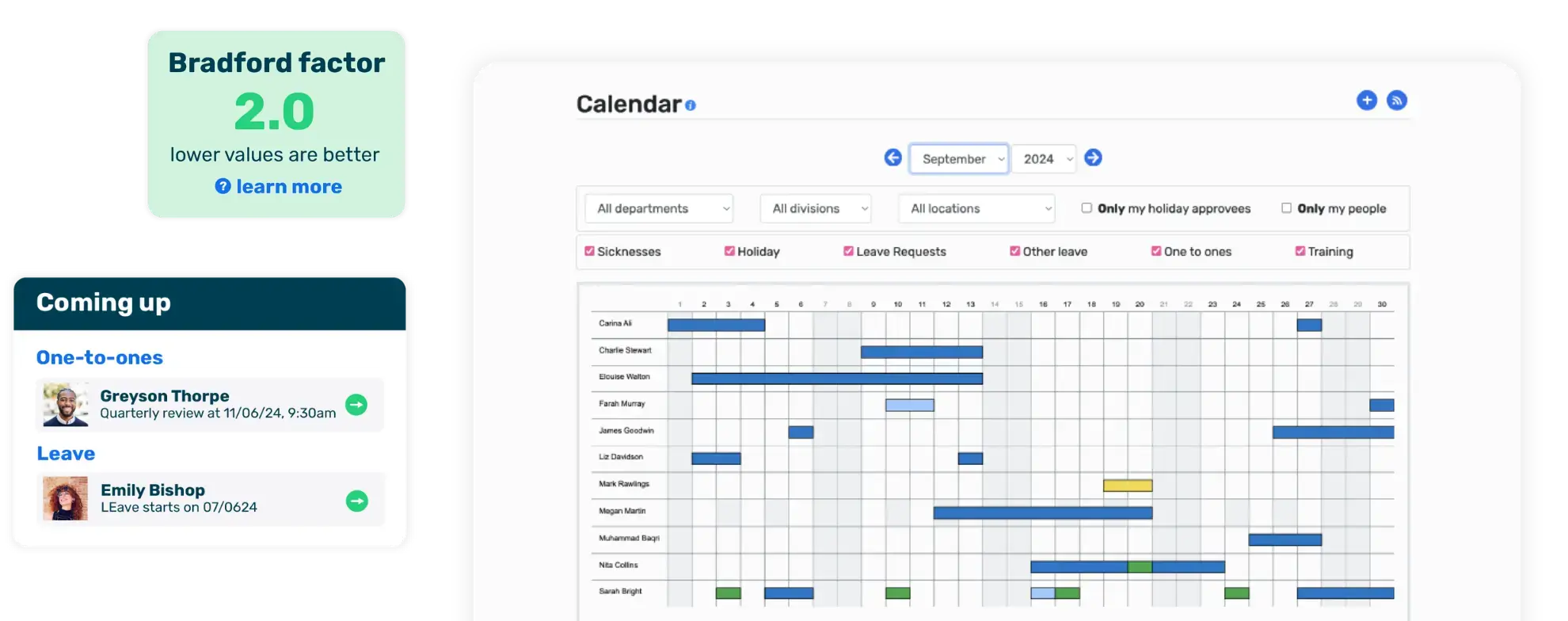

Learn more about managing leave alongside NI planning in our guide on how to manage time off in lieu for your employees.

.png?width=1000&height=790&name=Person%20using%20tablet%20(1).png)