Employee Performance Management Software

Boost your team’s efforts and recognise their achievements with employee performance and people management software.

Boost your team’s efforts and recognise their achievements with employee performance and people management software.

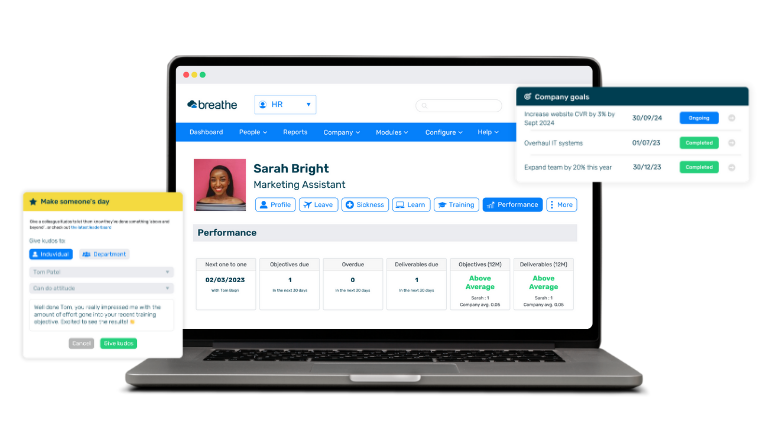

Breathe’s powerful performance management tool helps you recognise and reward your people for their hard work.

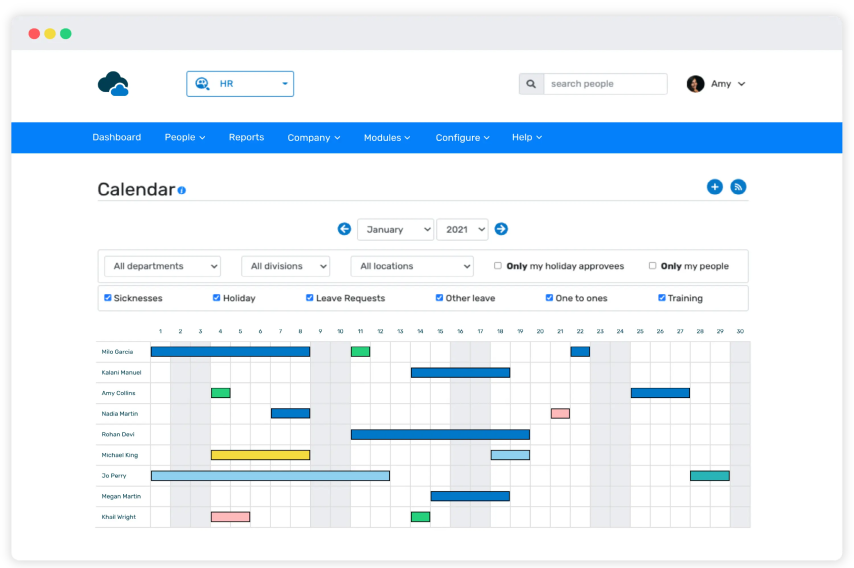

You can easily track employee performance, arrange one-to-ones, manage annual appraisal meetings and set goals or targets for staff to strive for.

Employee performance management software helps leadership teams keep track of their people's performance and productivity. It should also offer means of giving feedback and recognition to hardworking team members.

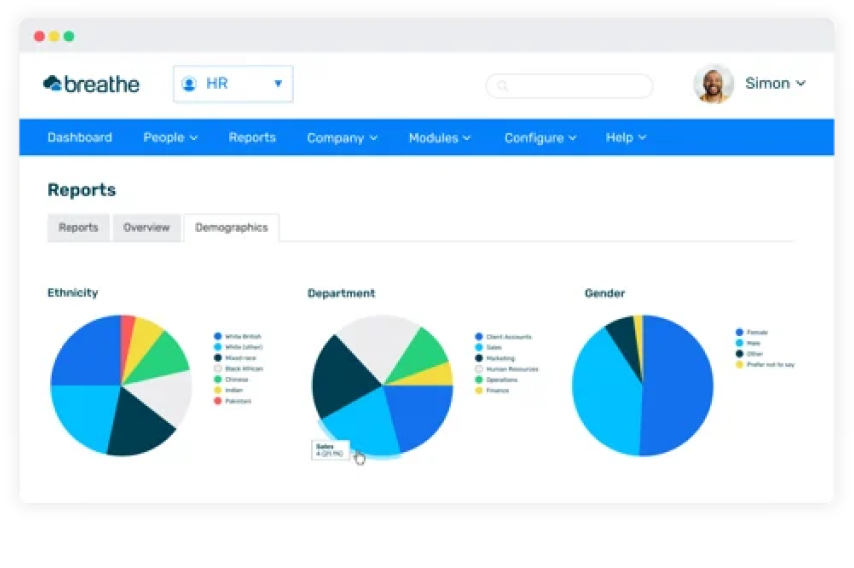

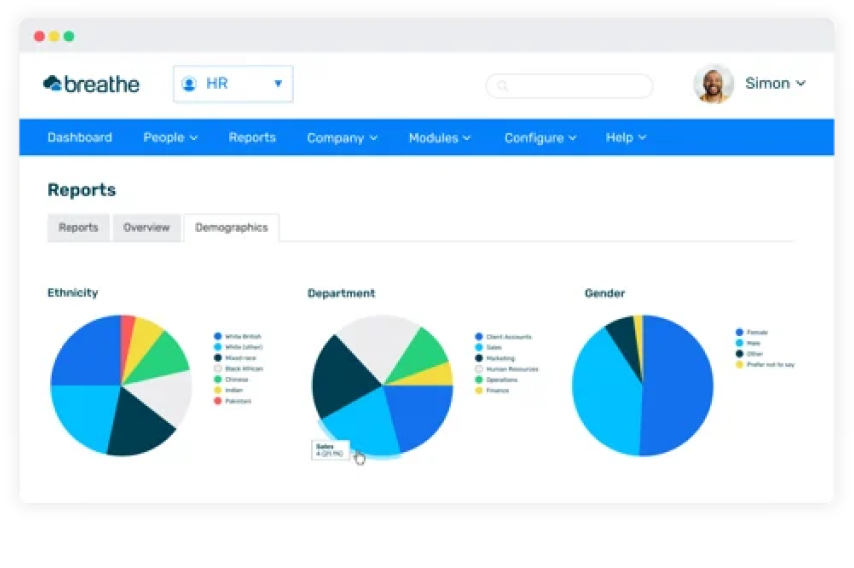

It’s sometimes described as ‘people management software’ because it enables businesses to collect, store, view and maintain employee information, all in one place.

Help you and your people thrive, our HR software puts all these HR essentials into one unified system.

Regular appraisals are crucial for tracking employee performance and improving their engagement. They keep your team on the right track with their goals and allow you to nip any potential issues in the bud.

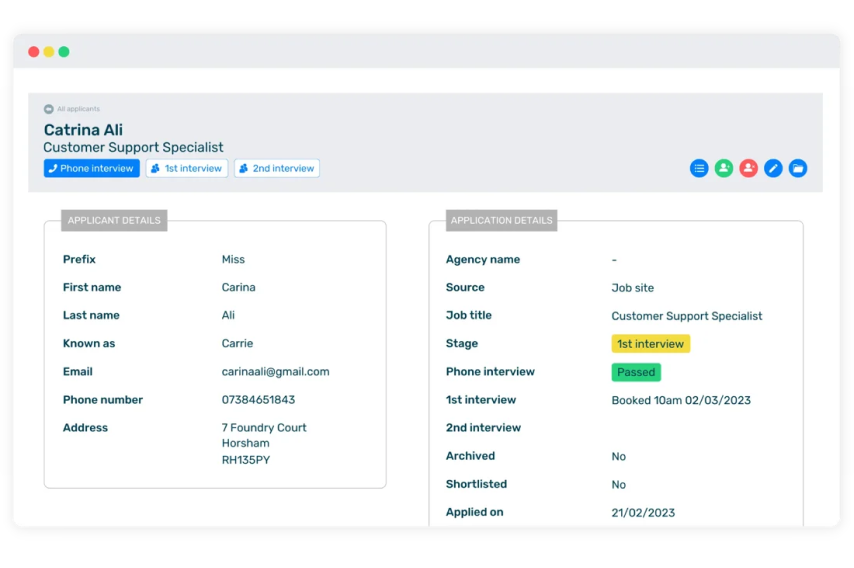

Breathe makes it easy to book these appraisals and will automatically notify staff about their time and location. You can even score employee performance for at-a-glance comparison with other team members.

Breathe encourages your people to pursue professional growth by letting them know what training programs they need to complete. Your management team can then easily keep up with who’s done what and who needs chasing. Scheduling training has never been so effortless.

/Add%20training%20course@2x.webp)

Your team needs to know what’s expected of them to achieve their targets. Breathe lets you set objectives and link them directly to company-wide goals, letting people see how their work plays a valuable part in the success of the wider business.

In today's fast-paced work environment, keeping your team engaged through continuous feedback is key. Breathe's performance management software makes it easy to give and receive feedback in real-time, helping everyone stay on the same page and work towards shared goals.

74% of Breathe users agree - Breathe is the best HR software solution we have used to date.

- Breathe HR 2025 customer survey.

With Breathe, you can share feedback instantly. This means your team can make quick improvements and feel more connected to their work. Real-time feedback keeps everyone motivated and on track, leading to better performance and happier employees.

Breathe's feedback loops create an ongoing conversation between managers and team members. Regular chats and feedback sessions helps keep everyone aligned with the company's goals and supports personal growth.

1

Test drive all features for FREE

2

Use your own data to see the system in action

3

Try for 14 days - no card details required

During your trial, you'll be in the driving seat and have the freedom you need to experience the system first-hand. There's absolutely no obligation to buy, and while we offer a self service experience, our friendly support team will be on hand if you need them.

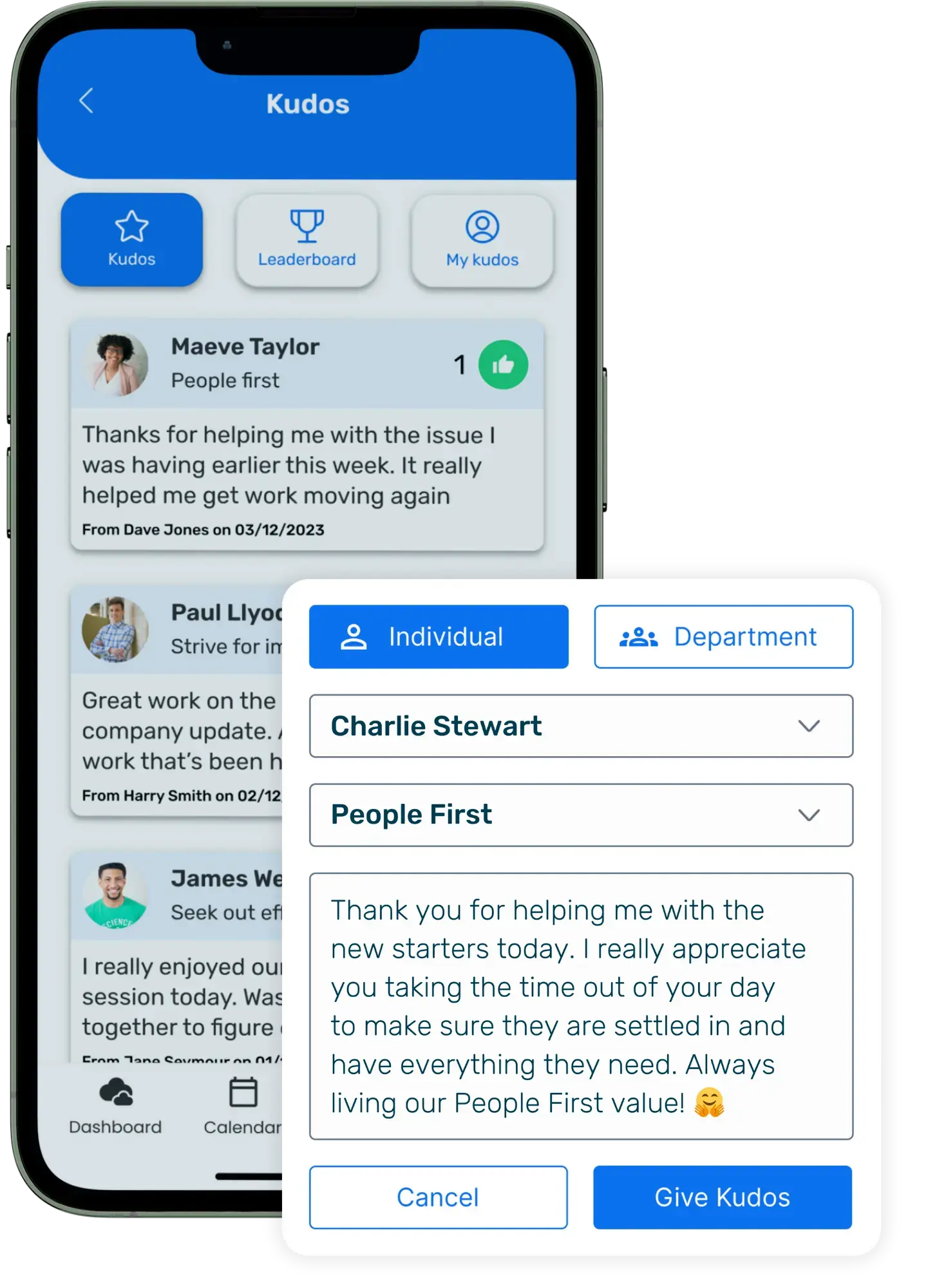

Boost employee engagement and satisfaction by sending your team recognition via Breathe’s Kudos feature. Anyone in your organisation can send Kudos to anyone else as a way of saying 'thank you' for a job well done. When it comes to showing appreciation, a little goes a long way - and sending praise to someone is sure to make their day.

Now available in Breathe’s People Portal mobile app, it’s easier than ever to give and receive Kudos. You can even check out the leaderboard and keep track of your Kudos badges – all in the palm of your hand.

What is the purpose of a performance review?

What are the benefits of effective performance management?

Having an effective performance management system in place can:

Help everyone in the organisation.

Mean employees are much more likely to engage with a business’ overall goals.

Form positive relationships between a manager and his/her employees.

Ensure performance reviews are fair to all staff, and highlight cases where they are not.

A well-oiled performance management system also helps employees understand what the business is trying to achieve and identify how their role fits into the overarching strategy.

What types of businesses use employee performance management software?

All types of businesses use employee performance management software: from micro businesses to large corporate companies.

Any business with employees, no matter how few, will need to perform a range of HR tasks from payroll management to holiday management and performance reviews. Breathe’s HR software is designed specifically for SMEs.

What are the benefits of tracking employee performance?

An effective employee performance tracker:

Is faster and more convenient than outdated paper processes.

Is easy to use.

Saves time.

Can identify potential issues sooner rather than later.

Offers the opportunity for real-time feedback.

Accounts for all members of staff.

Helps everyone involved in the workplace.

Can be used regardless of the work sector.

Helps employees engage with a business’ overall goals.

Supports positive relationships between managers and their employees.

Ensures performance reviews are fair, and highlights cases where it isn’t.

Allows employees to see how their role fits into the organisation’s overarching strategy.

Our HR software helps you make these benefits a reality for your people, and your workplace.

How can performance management software enhance team collaboration?

How much does performance management software cost?

In the past, smaller businesses have struggled to justify the large upfront costs of desktop HR software. But with cloud-based employee performance management solutions like Breathe, smaller businesses are now able to reap the benefits of a substantial HR software system.

Breathe’s monthly subscription fees are based on the number of employees you have in your business, and start at £22 per month (excluding VAT) for micro businesses as part of our flexible plans and pricing.

Calculate the ROI of Breathe with our quick & easy ROI calculator.

How secure is my data with Breathe?

What do I need to know now?

.webp?width=564&height=513&name=Group%2029%20(1).webp)