Hourly Wage calculator

Use our hourly wage calculator to work out what you owe employees when paying by the hour.

Use our hourly wage calculator to work out what you owe employees when paying by the hour.

.png?width=1000&height=790&name=Person%20using%20tablet%20(1).png)

Just enter their annual salary and their contracted hours below.

Enter your employee's salary:

Enter contracted weekly hours:

Whether you're an employer working out pay or an employee reviewing earnings, our UK hourly wage calculator gives you instant clarity.

Understanding your hourly rate supports everything from pay transparency and financial planning to compliance. It’s a simple way to ensure pay reflects time, effort, and current UK wage expectations.

It only takes a few seconds to work out your hourly rate.

Just enter the total annual salary (pre tax) and the number of contracted hours worked each week. We’ll work out the hourly rate based on a standard 52-week year.

For example, if someone earns £30,000 a year and works 37.5 hours a week, their hourly pay comes out at around £15.38.

Step 1. Establish your annual hours.

You can do this by multiplying your weekly hours by 52 (the number of weeks in a year).

Example: 37.5 hours per week x 52 weeks in a year = 1950 hours

Step 2. Divide your annual salary by the total hours number in the previous step

Example: £35,000 per year / 1950 total hours worked in year = £17.95 per hour rate37.5 x 52 = 1950

35000/1950 = 17.95

If you don't have a calculator to hand, use our simple hourly wage calculator above to get your answer.

Understanding your hourly wage is essential for businesses and employees. Knowing your hourly wage enables you to:

Ensure fair pay based on contracted hours

Support overtime and holiday pay calculations

74% of Breathe users agree - Breathe helps us reduce HR-related errors while ensuring compliance with UK employment laws and regulations.

- Breathe HR 2025 customer survey.

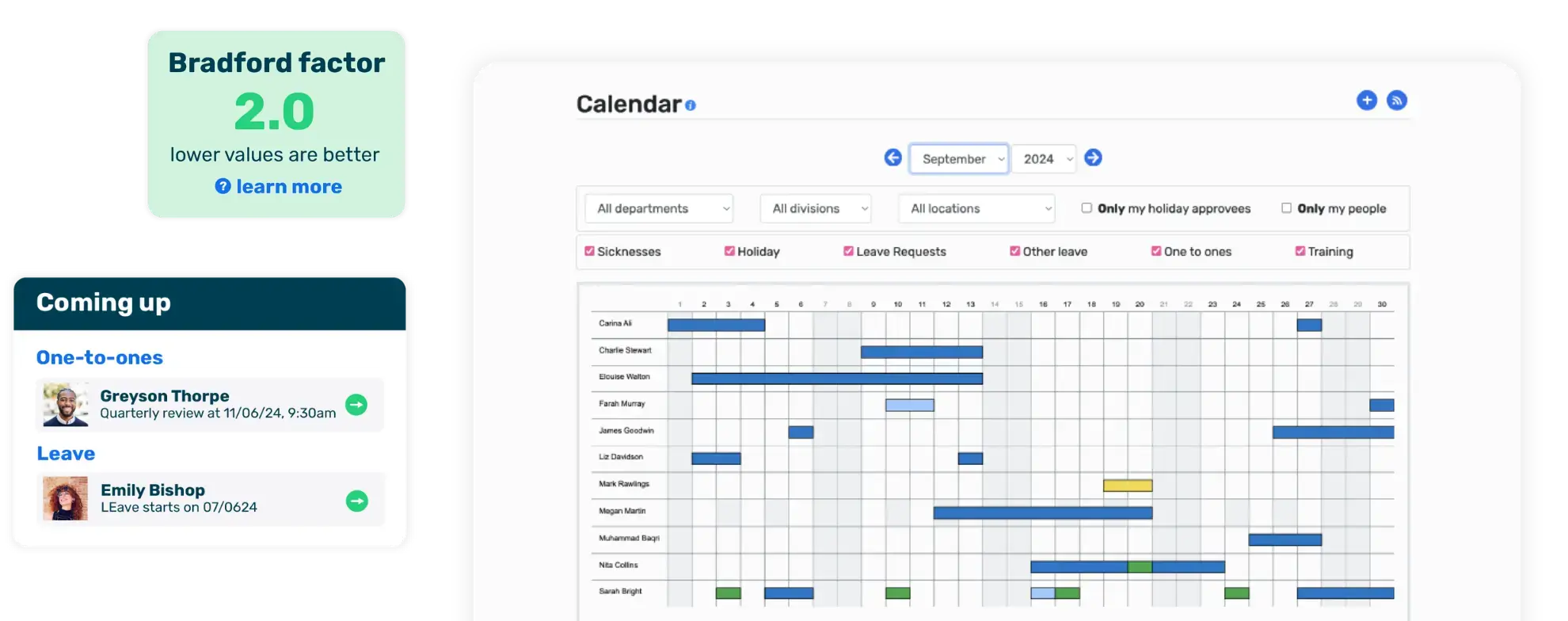

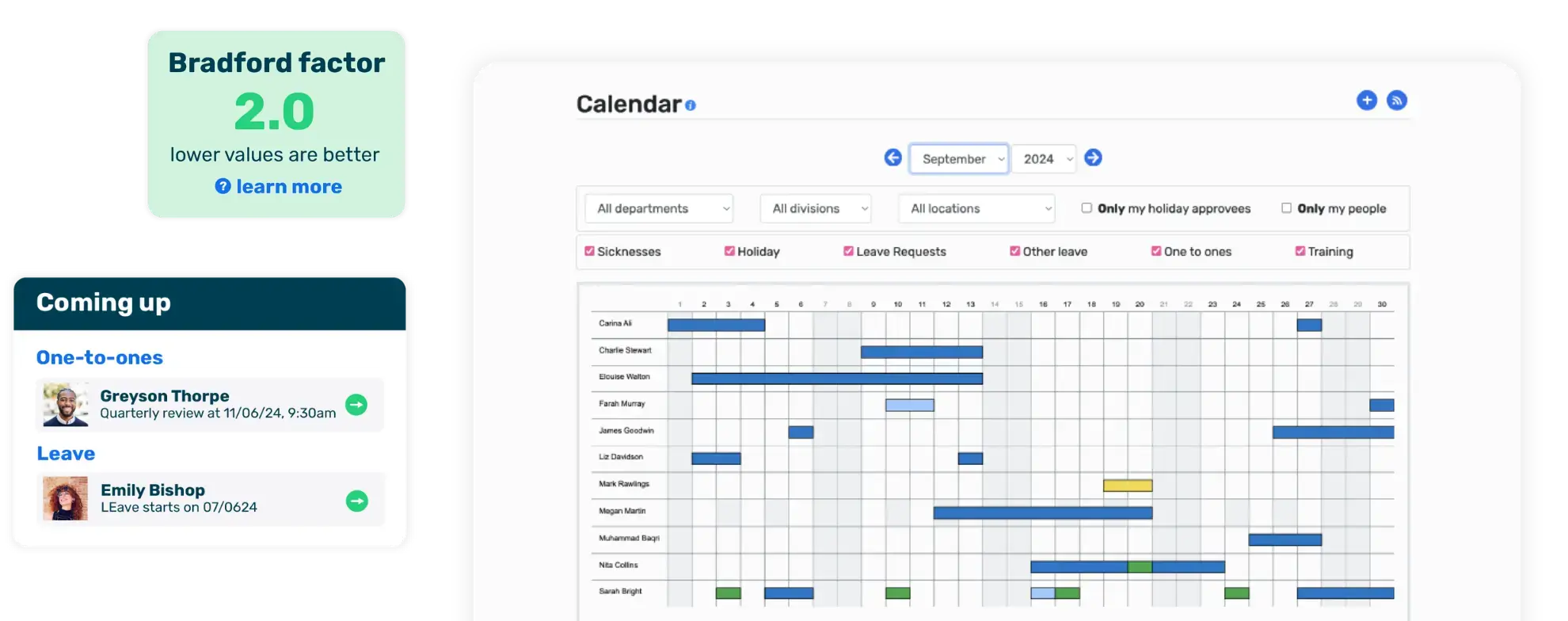

Save up to 4 hours a week with automated holiday management software

Give your people visibility of their own holiday entitlement and request leave whenever, wherever

See who’s off and when in a glance, from holiday, to maternity/paternity leave, to appointments and training

Visualise how much holiday has been booked and taken, and identify those at risk of burnout

What if I don't know my annual salary?

No problem. You can work it out by taking your gross monthly salary (that’s your monthly pay pre tax) and multiplying it by 12.

Once you’ve got your yearly salary, enter it into the calculator along with how many hours you work each week. The calculator will then work out your hourly rate based on your annual salary and weekly hours.

Can employers use this to check minimum wage compliance?

Yes - this hourly wage calculator is a helpful way for employers to check if an employee’s pay meets minimum wage requirements.

By entering their annual salary and contracted weekly hours, you can quickly see the hourly rate and ensure it’s in line with UK pay standards.

Does the hourly wage calculator include tax deductions?

Not quite. The calculator works out your hourly rate based on your gross salary, that’s the amount pre tax or other deductions. It’s designed to give you a simple, clear view of your pay before anything is taken off.

Take a free trial of Breathe to see for yourself how easy it is to win back time in your day and help your people be the best they can be.