PAYE and payroll management can seem daunting for people who are new to the subject, with a long list of forms and reports required by HMRC.

When an employee joins a business, they usually provide their new employer with a P45. This includes key information that is used to calculate pay and deductions. There are occasionally times when an employee doesn’t have a P45 from their previous employer. In these cases, they complete a starter checklist, which was previously called a P46. In this article, we look at what a new starter checklist needs to include and when it's needed.

What happens if an employee doesn’t provide P46 information?

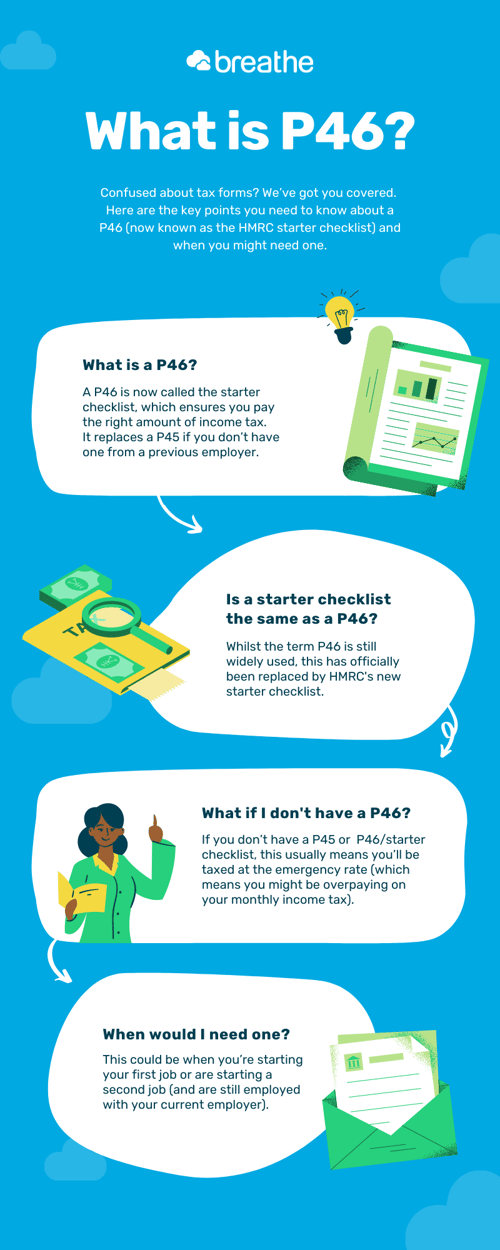

What is a P46?

A P46 is a tax form that replaced a P45 if new employees didn't have one from a previous employer. The P46 is now called the starter checklist which ensures you pay the right amount of income tax. The form records details such as student loan information to find the best tax code for the new starter. The information included on the starter checklist can be used to help fill in the first full payment submission (FPS) for the employee. It can be filled out online or by downloading a printable form.

The starter checklist

Is a starter checklist the same as a P46?

Whilst the term P46 is still widely used, this has officially been replaced by HMRC’s new starter checklist.

The P46 form was required to be submitted to HMRC, however the new starter checklist doesn’t need to be. This is simply a guide that HMRC have provided as to which information employers need in order to add employees to payroll and put them on the correct tax code.

When would a starter checklist need to be filled out?

This is usually when an employee doesn’t have a P45 and this can be for various reasons. The starter checklist ensures that payroll administrators and managers have the information they need to process a payment accurately with deductions made correctly based on the employee’s tax code.

The completion of a starter checklist may also be required if employee has a second job or of they are joining he paid workforce for the first time.

What is a P45?

When a leaving employee starts a new job, they provide their new employer with their P45 form. This enables the new employers to register the employee and take on the management of their salary and deductions. The P45 is comprised of two parts; one for the new employer and a second part for the employee and their records.

Employer responsibilities: key facts:

- Employers are required to issue a P45 to all team members who leave their employment.

- This form includes an employee’s name, their tax office and reference number alongside the tax code used to calculate tax deductions.

- The P45 also shows when an employee was last paid, the gross pay they have received in the tax year before joining their new employer.

How to complete the checklist

Are you wondering what information you need to fill out a new starter checklist?

All you need is the basic personal information of the employee. This includes their first and surname, address, postcode, gender, date of birth, National Insurance number and employment start date.

You'll also need to know whether the employee has another job, receives a pension and whether they receive jobseeker’s allowance, employment and support allowance or incapacity benefit. You’ll also need details of which student loan plan they’re on, if applicable, along with any previous tax code information.

What happens if an employee doesn’t provide P46 information?

Emergency tax

If you don’t receive either a P45 or the employee doesn’t provide you with their details for the starter checklist, then you may not be able to put the employee on the correct tax code. In the absence of a tax code, they may be on an emergency tax code which could mean they end up overpaying on income tax until correct details are provided.

Further information

If you’re looking for additional information about PAYE and tax codes, we have this covered in another recent article we've written about the subject.

Streamline your processes

Alongside payroll, we know that keeping on top of employee data can be a headache, especially when handling and storing sensitive information. Ditch the filing cabinets and spreadsheets and easily manage your employee data in Breathe’s secure, cloud-based HR software. Why not trial the system today, for free.

What is a P46? (Infographic)

Author: Aimée Brougham-Chandler

An IDM-certified Digital Copywriter (2023) & English Language & Literature graduate (BA Hons), Aimée is Breathe's Content Assistant. With 3 years' content marketing experience, Aimée has a passion for writing - and providing SME HR teams with solutions to their problems. She enjoys delving into & demystifying all things HR: from employee performance to health and wellbeing, leave to company culture & much more.