What is the legal requirement for holiday entitlement in the UK?

Everyone working in the UK has a basic right to holiday entitlement to make sure they get a set minimum of paid leave annually. Full-time employees who typically work a five-day week get up to 28 days off, which is equal to around 5.6 weeks of holiday.

For those working part-time, their holiday allowance is adjusted proportionally to the hours they work. This means all your employees get a fair slice of downtime.

Take, for example, someone working three days a week. Their holiday entitlement would be calculated by multiplying the days they work by 5.6, giving them 16.8 days of holiday. This method means that all your employees, regardless of their work pattern, can enjoy their due share of paid leave.

Understanding and managing your team's holiday entitlements is important in order to adhere to UK employment laws and show your team they are treated fairly. By making sure these allowances are calculated accurately, you can avoid potential disputes and create a workplace your employees like.

What is pro-rata holiday entitlement?

Pro-rata holiday entitlement is a calculation based on the amount of annual leave an employee is entitled to in relation to the amount of the holiday year they've worked.

If your employees are full-time and work five days a week, then they're entitled to a statutory minimum of 28 days’ paid annual leave a year, or 5.6 weeks’ holiday. If your workers are part-time and they work the same number of hours each day, Monday to Friday, every week they are also entitled to 5.6 weeks’ holiday - but this works out to be less than 28 days because they work fewer hours per week.

Zero-hours workers are entitled to holiday in the same way as full- and part-time workers at a rate of 5.6 weeks a year. However, someone on such a contract might work 12 hours one week, 20 the next, then none the next. Because of this flexibility, it is often easier to calculate their entitlement in hours rather than days.

To work out how much holiday they should take, you should take an average of the hours worked in the previous 52 weeks. If there were any weeks when they weren’t working and therefore weren’t paid anything, then those weeks should be substituted with the most recent previous weeks where they were paid for working.

For more information on calculating holiday entitlements, read our free guide.

How to work out pro-rata holiday entitlement?

The basic way to calculate holiday entitlement is to multiply the number of days a week they work by 5.6. That gives someone working a five-day week the 28 days we’ve already mentioned. Someone who is part-time and only works three days a week would be entitled to 3 x 5.6 = 16.8 days.

When calculating holiday entitlement, it is important to consider the number of days an employee works each week to ensure accurate and fair holiday allowances.

It gets more involved if the hours differ on the days they do work, but our pro rata holiday calculator allows you to work out holiday entitlement both in days and in hours worked each week.

Similarly, if you have a member of staff who starts part-way through the holiday year or leaves part-way through, then the amount of annual leave they are entitled to will be calculated based on the amount of time they have actually worked for you and will be a proportion of the full entitlement that they have accrued. This would be their pro-rata holiday entitlement.

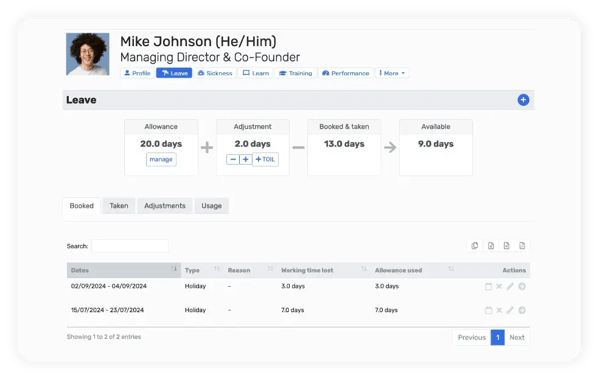

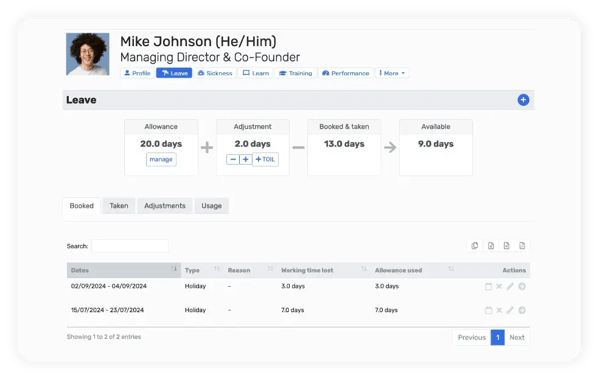

Our HR-user dashboard provides a snapshot, shop-window view of your employees' holiday allowances, including any adjustments you've made from the calculations above or below. Check out the adjustment tab and click on (time off in lieu) TOIL to explore further - this is also used for updating holiday from overtime hours worked.

Breathe's HR dashboard provides a snapshot of your employee's holiday allowances, including any adjustments you've made. Test out our user-friendly dashboard in our 14-day free trial.

Automating pro-rata calculations

It gets more involved if hours differ on working days or if an employee starts part-way through the year. Using our pro rata holiday calculator ensures accuracy and saves time.

Different instances of pro-rata holiday entitlement

For employees that join or leave part-way through your business' holiday year - regardless of full or part-time status - their annual leave entitlement is based on the amount of time worked during their period of employment with you.

It's important to note that staff accrue annual leave at the rate of 1/12 per every month worked.

Calculating pro-rata holiday entitlement for an employee starting part-way through holiday year

Employees starting part-way through the year will have their holiday entitlement calculated from the date they join.

When calculating holiday entitlement for new employees, it is essential to consider the start date and the remaining period in the holiday year to ensure accurate holiday allowances.

For example, if your holiday year start date is January 1 and they don’t start working for you until March 1, their holiday allowance will be based on the period from March 1 through to December 31.

Employees accrue annual leave at the rate of 1/12 for each month within the holiday year, therefore, in this instance the employee will be entitled to 10/12 of a full year’s holiday allowance.

Calculating pro-rata holiday entitlement for an employee leaving part-way through holiday year

For an employee leaving part-way through the year the period of entitlement will run from your holiday year start date through to their leaving date.

Accurately calculating holiday entitlement for departing employees ensures they receive the correct amount of leave or pay in lieu, based on their time worked.

If they’ve taken more than their annual leave entitlement at the point they leave, then you can take the money back in their final pay pack, but only if it has been agreed in writing beforehand. If they have taken less than their entitlement at the point of departure you may be able to offer them payment in lieu of holiday.

Other considerations for pro-rata holiday entitlement

If you have part-time staff or staff who work irregular hours each month, then the calculations are carried out differently again. You also need to be mindful of bank holidays when working out their entitlement.

How many bank holidays am I entitled to if I work 3 days a week?

To calculate how many bank holidays you're entitled to as a part-time worker, you can use this formula:

(number of hours worked per week / number of hours in a full-time week) x (number of bank holidays x hours per working day)

Calculating pro-rata holiday entitlement for part-time staff working in days and hours

If staff work irregular hours, for example, they are shift workers or working patterns change regularly, then holiday pay will be based on the average hours they have worked in the previous 12 weeks.

Bank holiday rights and calculations

Knowing how to deal with bank holiday entitlement in relation to your employee's annual leave allowance can understandably leave you scratching your head. Should they form part of the annual holiday entitlement or be additional to them? What happens if someone never works Mondays or Fridays when most bank holidays normally fall?

While bank holidays are not a statutory entitlement, employers can choose to include them as a part of the annual leave allowance or offer them as additional leave.

With eight bank holidays in the UK a year (a couple more in Northern Ireland) it’s something you need to consider for all workers.

Contrary to popular belief, workers don’t have a statutory right to not work bank holidays. You as an employer or HR manager get to decide whether or not they can. You can also decide whether bank holidays are part of their holiday entitlement or additional to it, but you must lay those terms out in any contract of employment. Whether you offer extra pay for working bank holidays should also be outlined.

When it comes to bank holiday entitlement for part-time workers they are entitled to the same amount of bank holidays but on a pro-rata basis and, if employment terms state they have to work bank holidays, then they have no right to refuse.

Accruing holiday entitlement

Employees start to accrue holiday from the moment they start working for you.

How much holiday do I accrue per month?

Staff accrue holiday as a monthly proportion of their annual entitlement. So, each month they accrue one twelfth of their annual entitlement in advance.

For example, if a worker that has 28 days annual entitlement starts working in January, then by June they will accrue 6/12 of that annual entitlement or 14 days.

An employee will still build up leave even if on maternity, paternity, adoption or sick leave.

Part-time employees and zero-hours workers accrue holiday in the same way but annual leave accrual is calculated slightly differently. For part-time workers you will work out how many days a year they are allowed by multiplying the annual entitlement of 5.6 weeks by the days they work e.g. 5.6 x 2 = 11.2 which you round up to the nearest day so 11.5.

If you apply the same situation in the example above for a full-time worker, a part-time worker who starts in January will have accrued 5.75 days holiday.

Zero-hours workers are also entitled to a pro-rata amount of the 5.6 weeks a year entitlement but this is worked out on hours rather than days.

Carrying over leave into the next holiday year

Carry over is a term used in relation to annual leave and referring to when an employee has unused holiday that they would like to 'carry over' into the next holiday year. If someone still has five days holiday left, can they carry it over to next year?

Under the EU working time directive, employees must get four weeks’ paid leave a year and it must be taken in that leave year or it will be lost. The extra 1.6 weeks (or eight days) available in the UK can be carried over to the following year, if you agree to it as an employer.

You can also write in extra leave and what happens around it into an employee's contract. For example, a new trend is to add a couple of days onto an employee's holiday allowance to act as duvet days.

The exception to these rules around carry over is if an individual is unable to take their statutory minimum leave e.g. because of sickness or maternity, in which case it can be carried over to the following year but must be taken within 18 months.

However, as a business, it's entirely up to you whether you allow leave to be carried over. It's important to balance the wellbeing & morale of your people, whilst making sure you won't be short-staffed.