Redundancy Pay Calculator

Calculate statutory redundancy pay quickly and easily

Calculate statutory redundancy pay quickly and easily

How old was your employee when they were made redundant?

How many years has your employee worked for you?

Only count full years of service. For example, 5 years and 3 months count as 5 years.

What is your employee's weekly pay before tax and any other deductions?

Examples of other deductions include student loans and child maintenance.

Statutory redundancy pay is the UK’s way of ensuring employees have a bit of financial support when their position is no longer needed. As long as you’ve worked for your employer continuously for at least two years, you’re entitled to certain minimum redundancy payments based on your age, weekly pay, and length of service.

To get an accurate estimate of your entitlements, using a redundancy calculator can be extremely helpful.

You’ll usually receive a redundancy notice before your final day, giving you the chance to plan ahead and understand what’s owed to you. The actual amount is calculated using a scale that considers different age brackets, so people of all ages receive fair treatment.

Some employers might also choose to top up these basic amounts beyond the legal minimum — this will depend on their company policies or any extra terms in your contract.

In the UK, to be eligible for redundancy pay, employees must have been continuously employed by the same employer for a minimum of two years. This statutory redundancy entitlement ensures that individuals receive financial support when their position becomes redundant. The redundancy pay is calculated based on factors such as the employee's age, weekly pay, and length of service.

A redundancy calculator can simplify this process, helping employees determine how much statutory redundancy pay they are entitled to. It's important to note that certain roles, like those in the armed forces or police, may follow different rules regarding redundancy payments.

For those uncertain about their eligibility, reviewing their employment contract and using a redundancy calculator can provide clarity.

Knowing you'll get redundancy payments can feel like a saviour when your job ends, but they’re not always available to everyone. If you haven’t clocked two continuous years of service, you generally won’t qualify.

Similarly, if you’ve been dismissed for misconduct or left voluntarily (and aren’t under a redundancy notice), you won’t be eligible. Certain roles, such as the armed forces, police officers, or genuinely self-employed workers, for example, have their own sets of rules when it comes to redundancy payments.

If you’re on a fixed-term contract that simply finishes on its agreed date, it’s usually not treated as redundancy. The same goes for agency staff or employees who move straight into another position with the same employer.

If you want to be sure of your situation, always check your contract and confirm your employment status before making any final decisions about redundancy payments.

Redundancy pay is worked out on the basis of age, weekly pay and length of service (employees must have worked for you continuously for 2 years or more to qualify). They will be entitled to:

Weekly pay is capped at £643 (£669 in Northern Ireland) per week. Length of service is capped at 20 years.

The maximum amount of statutory redundancy pay an employee can receive is £19,290 (£20,070 in Northern Ireland).

Years of service or earnings over these amounts should not be included in the calculation.

As an employer, you can decide to offer redundancy pay over and above the statutory requirement. You can also choose to shorten the qualifying period to less than two years. This information should all be written into the employment contract.

Redundancy pay up to £30,000 is tax-free.

For more detailed calculations and to ensure compliance with the latest regulations, refer to our redundancy pay calculator.

Caveats and rules can be found here.

If you've been made redundant, you'll need let HMRC know if you're currently receiving tax credits, universal credit or other benefits.

After redundancy, starting a new job depends on your contract terms. If there's no restrictive clauses, you can start as soon as your notice period ends.

If you're paid in lieu of notice, you might begin immediately, but be cautious of any post-termination restrictions. Review your contract for details on 'restrictive covenants'.

Here’s a quick and easy way to estimate statutory redundancy pay for employees based on their age, weekly pay, and years of service. For more detailed and tailored calculations, try using our redundancy calculator UK.

| Age Range | Years of service | Weekly Pay (max) | Redundancy Pay calculation |

| Under 22 | Full years worked | £643 | 0.5 week's pay for each year of service |

| 22-40 | Full years worked | £643 | 1 week's pay for each year of service |

| 41 and over | Full years worked | £643 | 1.5 weeks pay for each year of service |

This simplified table breaks down the statutory redundancy pay structure by age group and weekly pay cap. If you need more detailed examples or want to calculate specific amounts, try our redundancy calculator UK.

| Age Group | Weekly Pay Cap | Pay Rate Per Year Of Service |

| Under 22 | £643 | 0.5 week's pay for each year of service |

| 22-40 | £643 | 1 week's pay for each year of service |

| 41 and over | £643 | 1.5 weeks pay for each year of service |

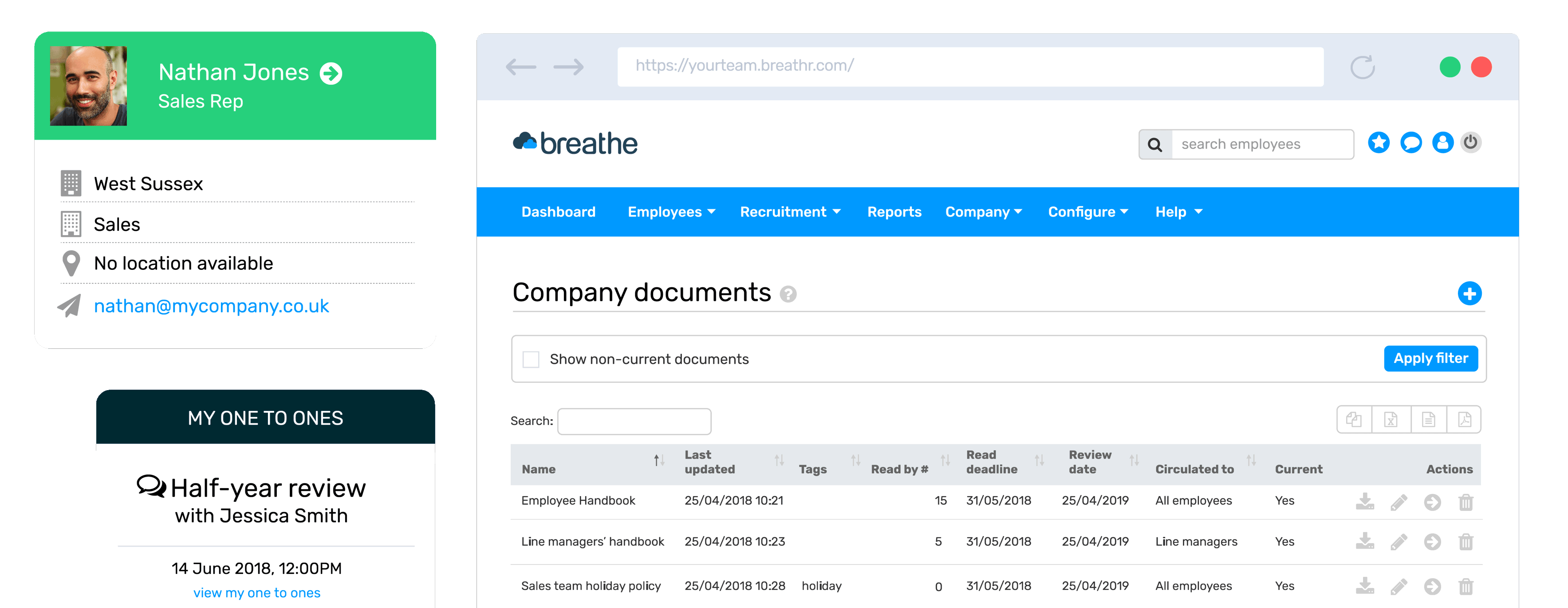

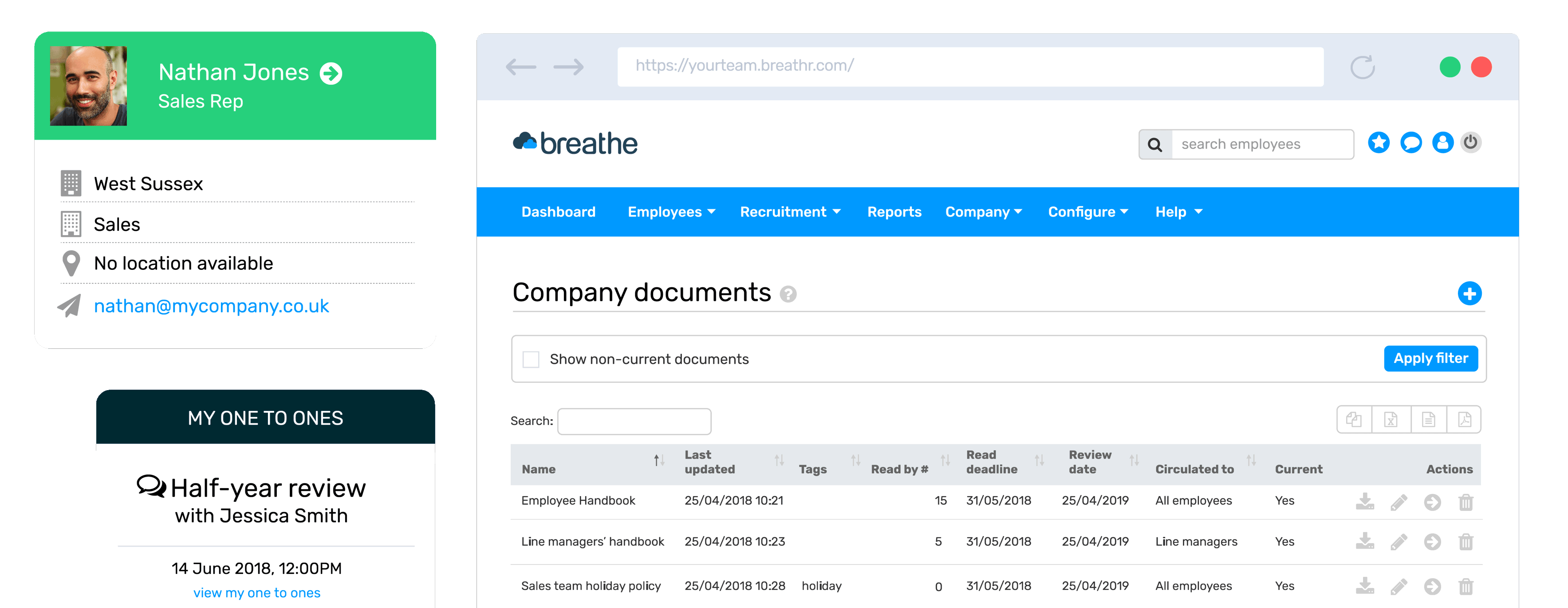

Take a free trial of Breathe to see for yourself how easy it is to win back time in your day and help your people be the best they can be.